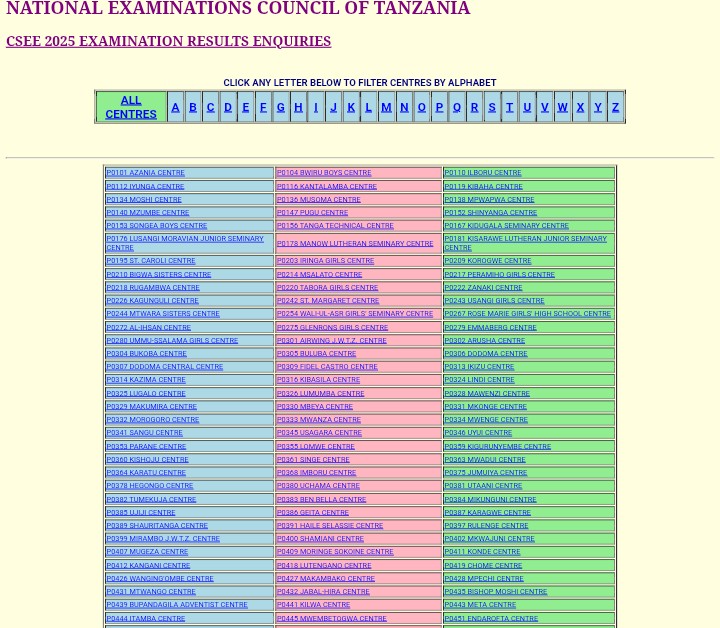

Introduction

Student loan debt is a major concern for millions of Americans. Fortunately, the US government offers programs to forgive or reduce student loan debt under specific circumstances.

In this guide, we’ll walk you through everything you need to know about student loan forgiveness in 2026, including eligibility, application steps, and tips to maximize your benefits.

What Is Student Loan Forgiveness?

Student loan forgiveness allows borrowers to have part or all of their federal student loans canceled.

Unlike repayment plans, forgiveness reduces your total debt, which can improve your financial stability.

Key Points:

1.Only federal loans qualify (private loans generally do not)

2.Forgiveness can be partial or full depending on the program

3.Programs often require employment or income-based eligibility

Who Qualifies for Student Loan Forgiveness?

Eligibility depends on the type of loan and program. Common programs include:

Public Service Loan Forgiveness (PSLF)

Must work full-time for a government or qualifying nonprofit organization.https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service

Make 120 qualifying payments (10 years)

Remaining balance may be forgiven

Teacher Loan Forgiveness

Full-time teachers in low-income schools.https://studentaid.gov/manage-loans/forgiveness-cancellation/teacher

Forgives up to $17,500

Applies to Direct Loans and Stafford Loans

Income-Driven Repayment (IDR) Forgiveness

Loans forgiven after 20–25 years of payments based on income.https://studentaid.gov/manage-loans/repayment/plans/income-driven

Monthly payments are capped at a percentage of your discretionary income

How to Apply for Student Loan Forgiveness

1.Check Eligibility – Review your loans and program requirements.https://www.ed.gov/

2.Enroll in the Program – For PSLF, submit Employment Certification Form yearly.

3.Make Qualifying Payments – Only payments under approved plans count

4.Submit Forgiveness Application – Use your loan servicer’s online portal

Tips to Maximize Forgiveness

Keep accurate records of employment and payments

Use income-driven repayment plans for IDR forgiveness

Stay updated with new government policies

Contact your loan servicer for guidance

Common Questions (FAQ)

Q1:Can private loans be forgiven?

A1:Generally, no. Private loans are not eligible for federal forgiveness programs.

Q2: How long does forgiveness take?

A2: It varies; PSLF requires 10 years, IDR forgiveness may take 20–25 years.

Q3: Do I need to pay taxes on forgiven loans?

A3: Most federal programs do not tax forgiven loans. Check program rules.

Conclusion

Student loan forgiveness can provide financial relief and open doors for future planning.

By understanding eligibility, programs, and application steps, you can maximize your chances of success in 2026.

Read this:https://tanzanianews.top/bima-ya-afya-kwa-wote-yazinduliwa-rasmi-kote-nchini/